Onchain data and AI trading infrastructure

Beat the Latency Tax on Solana launches

Valkyr ingests real-time order flow from Pump.fun and Raydium, lets AI design trading strategies on that data, and executes entries and exits through your wallets in seconds.

Web interface shipping soon. Same engine, richer controls.

More than

$1M

in GMV during public beta

Over

20,000

trades processed

Retention around

30%

active users

Copy trading is the Latency Tax

Traders are late when they follow callers and wallets. By the time a signal reaches you, the price has already moved, liquidity has dried up, and you're buying at inflated FDV.

The real edge is in bonding pools and first blocks where high-frequency trading patterns appear. That's where Valkyr operates.

Copy Trade Timeline

Late entry · Inflated FDV · Reduced edge

Valkyr Data Timeline

Early detection · Bonding curve analysis · HFT footprints

Valkyr meets order flow where it really lives

Data layer

Live monitoring of Solana launches, bonding curves, wallets, bundles, HFT footprints, all stored in a structured repository for instant analysis.

AI and strategy layer

AI Analyzer surfaces which patterns drive early winners and turns them into rules. The system learns what works and codifies it.

Execution layer

Trading agents apply those rules and execute entries and exits in seconds through user wallets. No manual intervention required.

From data to dollars in three steps

Backtest. Shape. Deploy. Repeat. The loop gets smarter every day as new data flows in.

1. Find strategies that catch early pairs

Browse historical data to discover which patterns identified winning launches before they pumped.

2. Shape the rules with AI

Let the AI refine entry triggers, position sizing, and exit conditions based on what actually worked.

3. Turn on trading agents

Deploy your strategy and let the agents execute in real-time while you monitor performance and adjust.

See it in action

What you get with Valkyr

Everything you need to trade Solana launches with data and automation

Launch intelligence

Real-time monitoring of new Solana token launches across Pump.fun and Raydium with instant notifications.

Onchain data repository

Structured historical data on bonding curves, wallet behaviors, HFT patterns, and execution quality.

AI strategy designer

Let AI analyze patterns and generate trading rules based on what actually drove profits in the past.

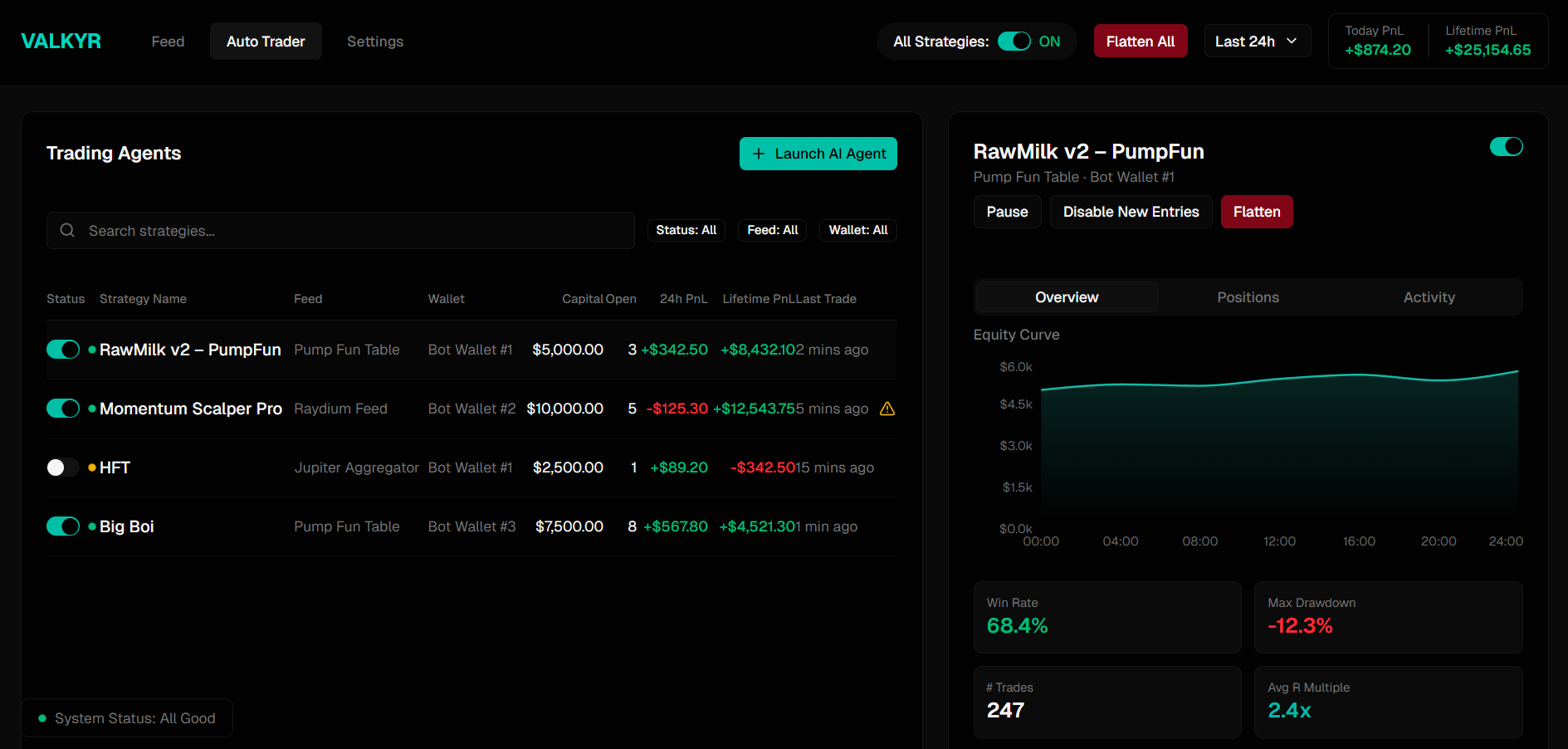

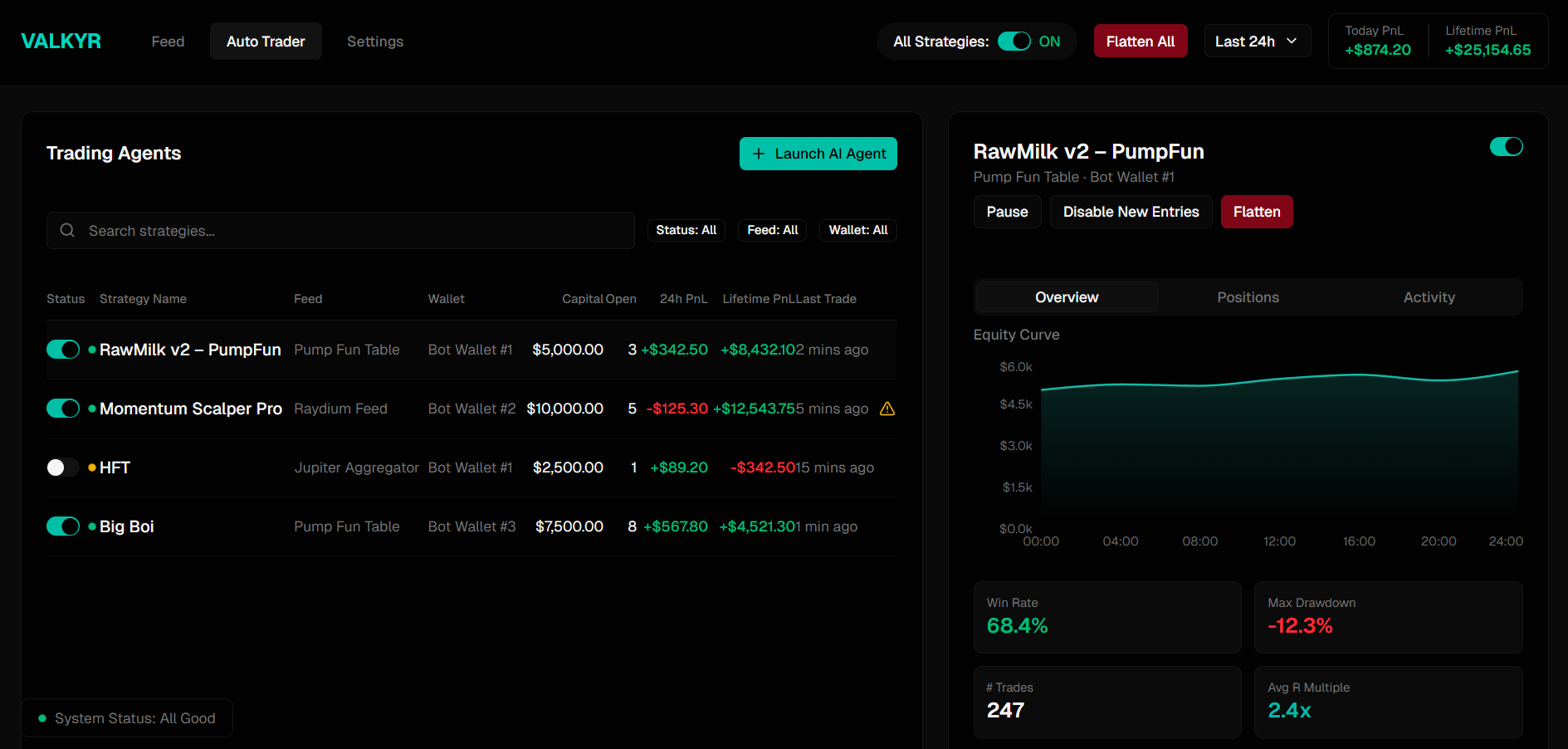

Trading agents with real metrics

Deploy agents that execute automatically with live tracking of win rate, drawdown, and performance.

Risk and capital controls

Set position limits, stop losses, and capital allocation rules to protect your downside.

Unified control surface

Monitor all strategies, review trade history, and adjust parameters from one dashboard.

Proven in public beta

$1M+

in GMV processed through Valkyr agents during public beta

20,000+

trades executed across all strategies and user wallets

30%

of beta users stayed active after the first month of trading

Real Performance Metrics

Win Rate

68.4%

Max Drawdown

-12.3%

# Trades

247

Avg R Multiple

2.4x

AI-Optimized Strategies

AI analyzes hundreds of tokens to find optimal entry parameters for your target win rate and profit multiples.

Built for serious Solana traders

Valkyr is designed for high-intent degens who want edge, quant-minded builders who value data over hype, and small desks that need infrastructure without enterprise overhead.

Infrastructure first. Interfaces on top.

The underlying engine is built for scale and flexibility. The retail interface you see today is just one surface. Serious traders and desks can plug directly into the data feeds and execution layer.

Whether you're running strategies through Telegram or building custom automation on top of our API, you're using the same battle-tested infrastructure.

REST and feed access for custom integrations

Custom strategy deployment and backtesting

Multi-venue roadmap: perps, prediction markets, prebond trading

Where Valkyr is heading next

Wherever there is liquid order flow and repeatable structure, Valkyr will plug in.

Prebond trading

Monitoring and acting on order flow even earlier in the lifecycle of a launch, before bonding curves complete.

Perpetual venues

Extending the engine to perps on Hyperliquid, Lighter, and Aster with the same data-driven approach.

Prediction markets

Bringing the same data and automation stack to venues such as Kalshi and Polymarket for systematic betting.

Run trading agents on real onchain data, not vibes

Start with the live interface today and be first in line for the full web console.